One of my goals for the new year is to find a better way to track my spending. If you too are looking for an easy and FREE way to manage your finances, check out this software called Mint!

Mint is fresh, free, and intelligent online money management software.

Mint.com is a FREE service that helps you create a budget, track your spending, save money, and make your bank account a LOT easier to manage. Over 1,000,000 people already use Mint.com and it’s been featured on almost every morning show, newspaper, and magazine.

Here’s a little bit about how it works:

Simple, one-time set up

Create your anonymous Mint account, then add your bank, credit card, home loan and investment accounts. This set up takes only five minutes – and that’s all the data entry Mint ever asks of you.

No bookkeeping required

Mint immediately pulls in your balances, purchases, stock trades, etc. to give you a complete picture of your finances. Mint connects securely to nearly all US banking financial institutions that have Internet banking capability, saving you hours of tedious data entry.

Always up-to-date

Mint updates all of your account information automatically. So you always have the most current information available. With Mint, you can focus on making smart decisions, not on managing and planning financial spreadsheets.

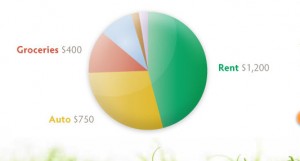

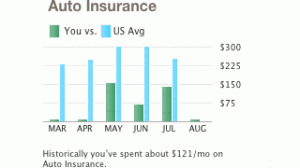

Mint.com calculates your average spending in any category (like groceries, insurance, house payment, car loan, etc.), and can turn it into a budget with one click. Compare your spending year-to-year or month-to-month. Rollover extra cash each month. Whatever your style, Mint.com makes it easy to create a budget that works for you.

Meet your savings goals

It’s easy to plan ahead with Mint. You’ll see how much you’ll save in 6 months by cutting back on restaurants. You can even plan for tuition or auto insurance payments, as well as one-time only expenses. Plan for irregular income too, whether you get paid every two weeks or entirely upfront. Mint.com can account for just about any scenario.

Know what’s left.

Get the instant gratification that comes from knowing exactly how your spending decisions will affect how much money you have left over at the end of the month, or the year. You’ll know immediately what you can do today to save more tomorrow.

Leave a Reply